Commitment to Environmental Sustainability

We are focused on operating our business in ways that minimize the potential for causing harm to the environment, and as part of our Global Environmental Program, we are committed to Carbon Net Zero by 2050 (with many of our business units on target to reach this goal by 2030) and are committed to employing ecologically friendly materials and operational procedures.

We strive for 100% of our posters and bulletins to be converted to recyclable Polyethylene (PE) Substrates and recycled annually in the U.S.

We measure our recycling and waste diversion from landfill rates across our business.

Up to 98% of our digital billboard components are recyclable.

We converted over 98% of our illuminated display panels and over 75% of our illuminated transit shelter displays in the U.S. to LED lighting, decreasing energy consumption by more than 60% across a three year period, and are working toward full conversion in 2021.

35% of our business by revenue is certified or benchmarked against ISO 14001 standards, and continued adoption of this standard is a goal of our Global Environmental Program.

Starting in 2021 in our European and Latin American businesses, we are committed to purchasing 100% renewable electricity with intention to reduce our Scope 1 and 2 emissions.

Ethics and Compliance

Clear Channel Outdoor is committed to maintaining the highest standards of compliance, ethics, honesty, openness and accountability in our business operations. We maintain a Code of Business Conduct & Ethics (the “Code”) that sets forth standards for our officers, directors, employees, interns, contractors and agents throughout our corporate structure. Training on the Code is mandatory upon employment, and we require completion of additional trainings covering certain topics contained in the Code on a periodic basis. Highlights from our Code, and its underlying policies and procedures, include:

No-retaliation policy for anyone who, acting in good faith, notifies us of a possible violation of the Code, our policies or the law.

Human Rights Policy committed to human rights and labor protections across all of our operations, and the expectation that our business partners uphold the same standards.

Anti-Corruption Policy that prohibits offering, attempting to offer, authorizing or promising any bribe or kickback for the purpose of obtaining or retaining business or an unfair advantage, imposes restrictions on government official interaction and seeks to mitigate risk in our gifts, entertainment and travel approval processes.

Due Diligence procedures and contractual provisions mitigating risk areas in our supply chain, including bribery and corruption, sanctions breaches and human rights.

Conflict of Interest Policy that requires the disclosure of matters that could potentially lead to a conflict of interest through an independent approval process.

Supplier Code of Conduct and contractual clauses used across our business requiring key suppliers to operate at a high ethical standard.

In addition, we maintain a Compliance and Privacy Office which sets standards and controls across the Company relating to corporate social responsibility, financial and economic crime controls, transparency, integrity and the mitigation of compliance risk, and we require that our leaders regularly report fraud risk and adhere to the standards that we set. We reflect our understanding of compliance risk through regular risk assessment, audit and assurance processes.

We are also committed to safeguarding and maintaining the privacy of personal information (“PII”) and honor CCPA, GDPR, and data privacy rights requests. Our Privacy Office maintains policies, procedures and training to ensure we protect PII wherever we may process or control it, and our websites include Privacy & Cookie Notices describing how we collect, protect, store, use, anonymize, aggregate and/or dispose of personal information automatically collected and/or voluntarily provided, and offer those with privacy concerns the right to object to any processing, change their PII or to request that we do not sell their PII. We honor their requests within legally prescribed time frames. In addition, we subject our supply chain to data privacy impact assessments where appropriate.

| | | | | | |  | | Notice and Proxy Statement 2021 v

|

OUR PEOPLE

Advancing Diversity and Inclusion

Clear Channel Outdoor is an equal opportunity employer and is committed to providing a work environment that is free of discrimination and harassment. We respect and embrace diversity of thought and experience and believe that a diverse workforce produces more innovative insights and solutions, resulting in better products and services for our customers. As we bring brands face-to-face with people, we believe our teams need to be as diverse in their composition and outlook as the audiences we reach every day, and we work together to create an inclusive environment where everyone can bring their true selves to work.

We have an ongoing priority to enhance diversity of our workforce and have implemented diversity and inclusion strategies across our global business. Amidst calls for sociopolitical change we have seen play out in all corners of the world, we have reinforced our commitment to our people and to promoting diversity and inclusion, as well as the need to do more to continue improving and evolving as an organization. In an effort to further promote a diverse and inclusive environment, we have launched the Executive Diversity Advisory Council in the U.S., implemented the International Fairness program in Europe and Latin America, and surveyed employees globally to gather insights on diversity and inclusion preferences to help guide and prioritize our efforts.

Commitment to Safety and Wellness

Safety is one of our core values, and we are committed to providing our employees with a safe workplace and prioritizing the physical and mental health and well-being of our employees. One of the ways in which we do this is by offering an Employee Assistance Program (“EAP”), which gives employees access to licensed professional counselors and other specialists at no cost for help with balancing work and life issues. We have also implemented an Employee Relief Fund to help employees facing financial hardship immediately after a disaster or during unanticipated and unavoidable personal emergencies.

In response to the COVID-19 pandemic, we implemented significant changes that we determined were in the best interest of our employees and the communities in which we operate and which comply with government regulations. This included transitioning the vast majority of our employees to work-from-home for a large portion of 2020, while implementing additional safety measures for employees continuing critical on-site work. In recent months, we have started to execute on our phased Return-to-Office plan on an office-by-office basis, ensuring compliance with applicable regulations as well as local health authority guidance and implementing robust safety procedures and protocols to protect our employees. Given the evolving-nature of COVID-19 developments, our Return-to-Office plan is nimble, allowing each office the flexibility to return to work-from-home directives as necessary based on local conditions.

In line with our priority of protecting the safety, health and well-being of our employees, we surveyed our employees in May 2020 to determine how we could more effectively provide support. This survey, administered by a third party, focused on the following areas: concern and connection; virtual work effectiveness; senior leadership response and communication; and employee wellness, health and safety. Utilizing the results of this survey, we developed an action plan to help our employees face the challenges of COVID-19 and remain engaged and productive, including communicating the availability of counseling under the EAP through company-wide notifications and HR portal updates, providing COVID-19 related resources on locating vaccines, work from home health tips and COVID-19 trainings, among other things, and regular communication of our progress through all-hands meetings, regional and departmental meetings and other forms of communication.

Compensation and Benefits Programs Compensation and Benefits Programs

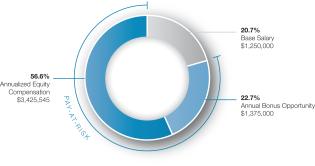

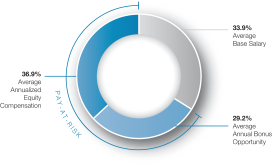

Our compensation and benefits programs are designed to attract and reward talented individuals who possess the skills necessary to support our business objectives, assist in the achievement of our strategic goals and create long-term value for our stockholders. We provide employees with compensation packages that include base salary and annual incentive bonuses tied to Company and division performance, in line with our pay-for-performance philosophy. Our sales employees are incentivized through sales commission programs, with our highest performing individuals further awarded through formal recognition programs. Our executives and certain other employees receive long-term equity awards that vest based on our relative total shareholder return or over a defined period. We believe

| | | | | vi Notice and Proxy Statement 2021

| |  | | |

that a compensation program with both short-term and long-term awards provides fair and competitive compensation and aligns employee and stockholder interests.

We also provide our employees and their families with access to a variety of healthcare and insurance benefits, qualified spending accounts, retirement savings plans and various other benefits.

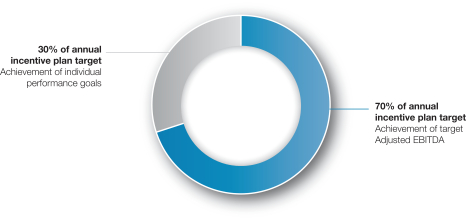

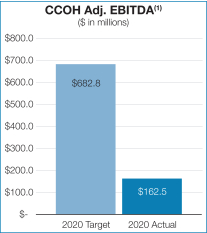

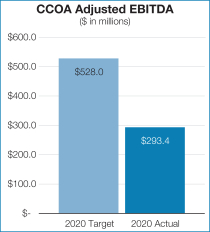

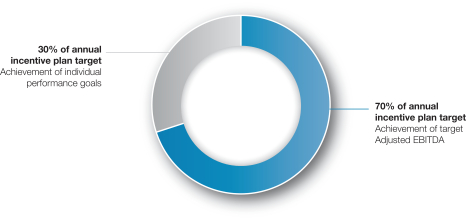

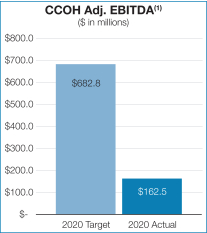

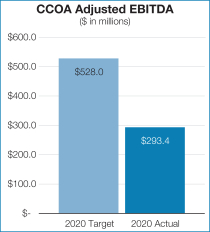

EXECUTIVE COMPENSATION HIGHLIGHTS Our Compensation Committee, with support from our independent compensation consultant, periodically evaluates our compensation practices to ensure that they support the objectives of our business, align with market practicepractices and provide incentiveincentives to deliver key financial metrics that are explicitly linked with stockholder value creation. Certain highlights for 20202023 include: | | • | | We continued our practice of annual incentive plan awards tied to Company, and division performance and individual performance targets.goals. | |

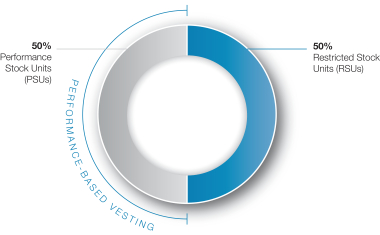

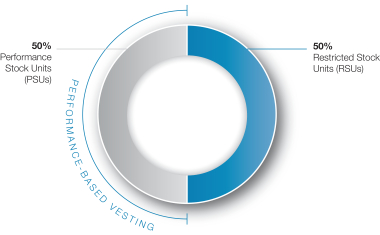

| | • | | Our long-term incentive (LTI)(“LTI”) program provides for annual equity awards for our executive team members made up of 50%members. The program favors performance-based LTI awards and while varied by role, the May 2023 grants averaged 40% restricted stock units (“RSUs”) and 50%60% performance stock units which vest based on(“PSUs”) for our named executive officers (“NEOs”). The RSUs are designed to promote retention, while the PSUs provide alignment to stockholders by tying payout to relative total shareholder return over a three-year period. | |

| | • | | We adopted a robust cashThe compensation determinations for our NEOs for 2023 reflect the overall performance of Clear Channel Outdoor and equity clawback policy for currentthe contributions of our leaders to driving the year’s successes. The achievement of individual performance objectives along with slightly below target achievement of business performance objectives resulted in the NEOs earning annual incentive payouts between 80% and former senior executives which applies to both cash and equity incentive compensation.100% of their individual target opportunities.

| |

| | • | | We codified our executive stock ownership guidelines requiring executives to hold common stockThe Company entered into an amended and restated employment agreement with a value equal to a specified multiple ofMr. Brian D. Coleman on March 7, 2023. In connection with this agreement, his base salary within five years.was increased effective April 1, 2023.

| |

| | • | | We periodically reviewOn October 25, 2022, Mr. Justin Cochrane received a one-time cash award in recognition of his efforts related to the sale of our Europe-South businesses. 50% of that award was paid in 2023 and updated our executive compensation peer groupthe remaining 50% will be paid in 2024, subject to consist of companies similar in size and complexity as us, companies inhis continued employment through the media or similar industries and companies that are in competition with us for executive talent.payment date.

| |

| | | | | | |  | | Notice and Proxy Statement 2021 vii

|

Clear Channel Outdoor Holdings, Inc.

2021 Proxy Statement

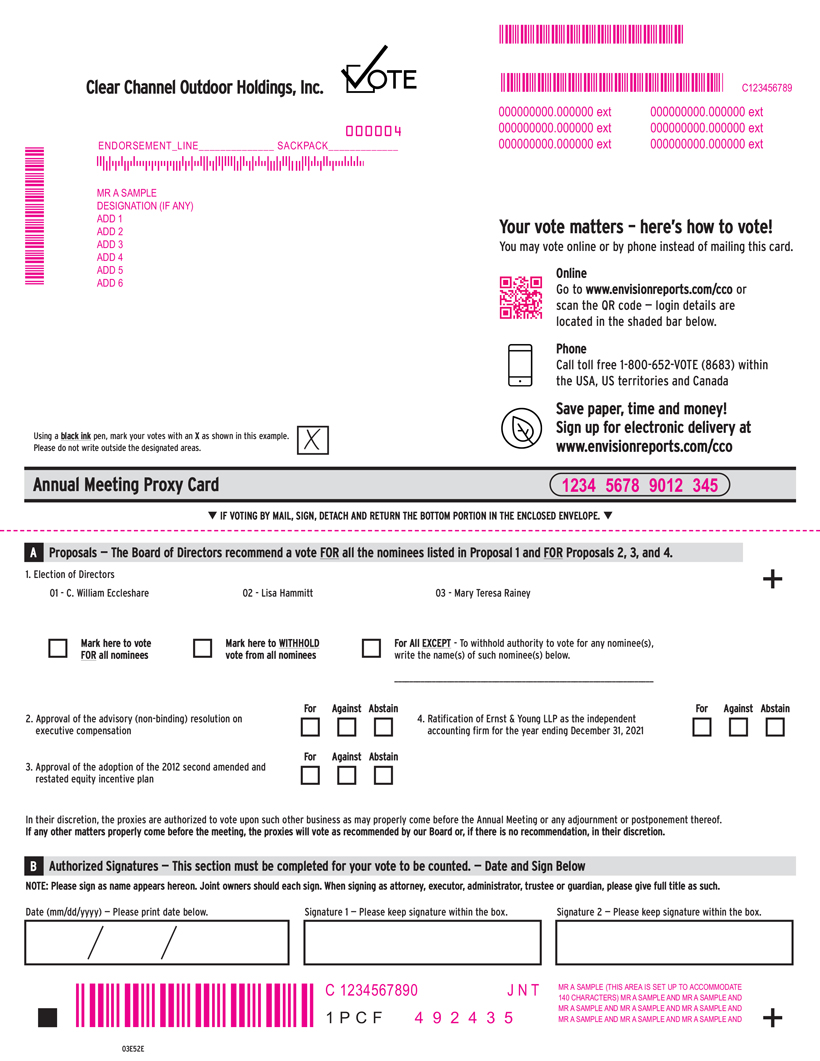

This proxy statement contains information related to the annual meeting of stockholders of Clear Channel Outdoor Holdings, Inc. (referred to herein as “Clear Channel Outdoor,” “CCOH,” “Company,” “we,” “our” or “us”) to be held on Wednesday, May 5, 2021, beginning at 9:00 a.m. Eastern Time, at www.meetingcenter.io/241105734, and at any postponements or adjournments thereof. On or about March 24, 2021, we will begin to mail to our stockholders either a notice containing instructions on how to access this proxy statement and our annual report online, or a printed copy of these proxy materials. The Company will bear the costs of preparing and mailing the proxy materials and other costs of the proxy solicitation made by the Board of Directors of Clear Channel Outdoor (the “Board”).

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Q: | WHY AM I RECEIVING THESE MATERIALS?

|

A: | Clear Channel Outdoor is making these proxy materials available to you via the Internet or, upon your request, has delivered printed versions of these proxy materials to you by mail in connection with Clear Channel Outdoor’s annual meeting of stockholders (the “annual meeting”), which will take place on May 5, 2021. The Board is soliciting proxies to be used at the annual meeting. You also are invited to attend the annual meeting webcast and are requested to vote on the proposals described in this proxy statement.

|

Q: | WHY DID I RECEIVE A NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS?

|

A: | As permitted by Securities and Exchange Commission (“SEC”) rules, we are making this proxy statement and our annual report available to our stockholders electronically via the Internet. The Notice of Internet Availability of Proxy Materials contains instructions on how to access this proxy statement and our annual report and vote online. If you received a notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your proxy over the Internet or by telephone. If you received a notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the notice.

|

Q: | WHAT PROPOSALS WILL BE VOTED ON AT THE ANNUAL MEETING?

|

A: | There are four proposals scheduled to be voted on at the annual meeting:

|

the election of the nominees for director named in this proxy statement;

the approval of an advisory resolution on executive compensation;

approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan; and

the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoor’s independent registered public accounting firm for the year ending December 31, 2021.

Q: | WHICH OF MY SHARES MAY I VOTE?

|

A: | All shares of common stock owned by you as of the close of business on March 9, 2021 (the “Record Date”) may be voted by you. These shares include shares that are: (1) held directly in your name as the stockholder of record and (2) held for you as the beneficial owner through a broker, bank or other nominee. As of the Record Date, there were 467,859,064 shares of common stock outstanding.

|

Q: | WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER?

|

A: | Most stockholders of Clear Channel Outdoor hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

| | | | | | |  | | Notice and Proxy Statement 2021 1

|

Stockholder of Record: If your shares are registered directly in your name with Clear Channel Outdoor’s transfer agent, Computershare, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by Computershare on behalf of Clear Channel Outdoor. As the stockholder of record, you have the right to grant your voting proxy directly to Clear Channel Outdoor or to vote during the annual meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a broker or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and also are invited to attend the annual meeting webcast. However, since you are not the stockholder of record, you may not vote these shares during the annual meeting, unless you obtain a legal proxy from your broker, bank or other nominee giving you the right to vote the shares and register for the meeting in accordance with the instructions set forth below.

Q: | WHAT CONSTITUTES A QUORUM?

|

A: | The holders of a majority of the total voting power of Clear Channel Outdoor’s common stock entitled to vote and represented in person (virtually) or by proxy will constitute a quorum at the annual meeting. Votes “withheld,” abstentions and “broker non-votes” (described below) are counted as present for purposes of establishing a quorum.

|

Q: | IF MY SHARES ARE HELD IN “STREET NAME” BY MY BROKER, WILL MY BROKER VOTE MY SHARES FOR ME?

|

A: | Under New York Stock Exchange (“NYSE”) rules, brokers have discretion to vote the shares of customers who fail to provide voting instructions on “routine matters,” but brokers may not vote such shares on “non-routine matters” without voting instructions. When a broker is not permitted to vote the shares of a customer who does not provide voting instructions, it is called a “broker non-vote.” If you do not provide your broker with voting instructions, your broker will not be able to vote your shares with respect to the election of directors. Your broker will send you directions on how you can instruct your broker to vote.

|

As described above, if you do not provide your broker with voting instructions and the broker is not permitted to vote your shares on a proposal, a “broker non-vote” occurs. Broker non-votes will be counted for purposes of establishing a quorum at the annual meeting and will have no effect on the vote on any of the proposals at the annual meeting.

Q: | HOW CAN I ATTEND THE ANNUAL MEETING?

|

A: | We are hosting the annual meeting by means of a live webcast. You will not be able to attend the meeting in person. You are entitled to participate in the annual meeting only if you were a stockholder of record of Clear Channel Outdoor as of the close of business on the record date, or if you hold a legal proxy from the record holder for the annual meeting.

|

Stockholder of Record: You will be able to listen to the annual meeting, submit questions and vote by going to www.meetingcenter.io/241105734 and clicking on “I have a Control Number.” The password for the meeting is CCO2021.

Beneficial Owner: If you wish to attend the annual meeting, you must register in advance. See “HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING?” below.

We encourage you to access the meeting website prior to the start time to allow ample time for check in. The virtual annual meeting will begin promptly at 9:00 a.m., Eastern Time.

Q: | HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING?

|

A: | Stockholder of Record: You do not need to register. Follow the instructions on your Notice of Internet Availability of Proxy Materials or proxy card. See “HOW CAN I ATTEND THE ANNUAL MEETING?” above.

|

| | | | | 2 Notice and Proxy Statement 2021

| |  | | |

Beneficial Owner: If you wish to register to attend the annual meeting, you must provide our transfer agent, Computershare Trust Company, N.A. (“Computershare”) with your name, email address and a copy of a legal proxy from your broker, bank or other nominee reflecting your beneficial stock ownership in Clear Channel Outdoor. Registration requests must be in writing and be mailed to:

By Regular Mail

PO BOX 505000

Louisville, KY 40233-5000

UNITED STATES

By Overnight Delivery

462 South 4th Street

Suite 1600

Louisville, KY 40233-5000

UNITED STATES

Requests for registration must be labeled “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on April 30, 2021. You will receive an email from Computershare acknowledging your registration along with a Control Number.

Q: | HOW CAN I VOTE MY SHARES WITHOUT ATTENDING THE ANNUAL MEETING?

|

A: | If you are a stockholder of record, you may authorize a proxy to vote your shares. Specifically, you may authorize a proxy to vote:

|

| | • | | By Internet—If you have Internet access, you may submit your proxyThe Compensation Committee adopted a Clawback Policy that complies with new clawback rules adopted by going to www.envisionreports.com/cco and following the instructions on how to complete an electronic proxy card. You will need the 16-digit number included on your notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by Internet. Internet voting is available until 11:59 p.m., Eastern Time, on May 4, 2021.NYSE.

|

| • | | By Telephone—If you have access to a touch-tone telephone, you may submit your proxy by calling the telephone number specified on your Notice of Internet Availability of Proxy Materials or your proxy card and by following the recorded instructions. You will need the 16-digit number included on your Notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by telephone. Telephone voting is available until 11:59 p.m., Eastern Time, on May 4, 2021.

|

| • | | By Mail—You may authorize a proxy to vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity.

|

If you hold your sharesAfter fiscal year end, David Sailer was appointed Executive Vice President, Chief Financial Officer of the Company, effective as of March 1, 2024. Mr. Coleman departed his position as Executive Vice President, Chief Financial Officer as of March 1, 2024, upon which time he became a consultant to the Company in street name, you may submit voting instructionsorder to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your broker, bank, or other nominee on how to submit voting instructions.assist with transition matters.

| Q: | WHAT IF I RETURN MY PROXY CARD WITHOUT SPECIFYING MY VOTING CHOICES?

| A: | If your proxy card is signed and returned without specifying choices, the shares will be voted as recommended by the Board.

| Q:WHAT IF I ABSTAIN FROM VOTING OR WITHHOLD MY VOTE ON A SPECIFIC PROPOSAL?

|

A: | If you withhold your vote on the election of directors, it will have no effect on the outcome of the vote on the election of directors.

|

If you abstain from voting on (i) the approval of an advisory resolution on executive compensation, (ii) the approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan, or (iii) the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021, it will have the same effect as a vote “against” this proposal.

Abstentions are counted as present for purposes of determining a quorum.

| | | | | | |   | | Notice and Proxy Statement 2021 32024 v |

Q: | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, PROXY CARD OR VOTING INSTRUCTION CARD?

|

A: | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all notices and voting instruction cards you receive.

|

Q: | WHAT ARE CLEAR CHANNEL OUTDOOR’S VOTING RECOMMENDATIONS?

|

A: | The Board recommends that you vote your shares “FOR”:

|

the nominees for director named in this proxy statement;

the approval of an advisory resolution on executive compensation;

approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan; and

the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoor’s independent registered public accounting firm for the year ending December 31, 2021.

Q: | WHAT VOTE IS REQUIRED TO ELECT THE DIRECTORS AND APPROVE EACH PROPOSAL?

|

A: | The directors will be elected by a plurality of the votes properly cast. The approval of an advisory resolution on executive compensation and the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoor’s independent registered public accounting firm for the year ending December 31, 2021 will require the affirmative vote of the holders of at least a majority of the total voting power of the voting stock present in person (virtually) or by proxy at the annual meeting and entitled to vote on the matter.

|

Q: | WHERE CAN I FIND A LIST OF STOCKHOLDERS OF RECORD ENTITLED TO VOTE AT THE ANNUAL MEETING?

|

A: | A list of stockholders of record entitled to vote at the Annual Meeting will be accessible on the virtual meeting website during the meeting for those attending the meeting, and for ten days prior to the meeting, at our corporate offices at 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249.

|

Q: | MAY I CHANGE MY VOTE OR REVOKE MY PROXY?

|

A: | If you are a stockholder of record, you may change your vote or revoke your proxy at any time before your shares are voted at the annual meeting by sending the Secretary of Clear Channel Outdoor a proxy card dated later than your last submitted proxy card, by authorizing a new proxy to vote on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the annual meeting will be counted) notifying the Secretary of Clear Channel Outdoor in writing, or voting during the annual meeting. If your shares are held beneficially in “street name,” you should follow the instructions provided by your broker or other nominee to change your vote or revoke your proxy.

|

Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?

|

A: | Clear Channel Outdoor will announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K, which we anticipate filing with the SEC by May 11, 2021.

|

Q: | MAY I ACCESS CLEAR CHANNEL OUTDOOR’S PROXY MATERIALS FROM THE INTERNET?

|

A: | Yes. These materials are available at www.envisionreports.com/cco.

|

| | | | | 4 Notice and Proxy Statement 2021

| |  | | |

The Board of Directors and Corporate GovernanceTHE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our Board is responsible for overseeing the direction of Clear Channel Outdoor and for establishing broad corporate policies. However, inIn accordance with corporate legal principles, itour Board is not involved in day-to-day operating details.activities of the Company. Members of the Board are kept informed of Clear Channel Outdoor’s business through discussions with the Company’s Chief Executive Officer, the Chief Financial Officer, Chief Legal Officer and other executive officers, by reviewing analyses and reports sent to them, by receiving updates from Board committees and by otherwise participating in Board and committee meetings. COMPOSITION OF THE BOARD OF DIRECTORS Our Board is currently comprised of nine directors, including C. William Eccleshare, ourten directors: W. Benjamin Moreland (our Chair), Scott R. Wells (our Chief Executive Officer,Officer), John Dionne, Lisa Hammitt, Andrew Hobson, Thomas C. King, Joe Marchese, W. Benjamin Moreland, Mary Teresa Rainey, Ted White and Jinhy Yoon. COMPOSITION OF THE BOARD OF DIRECTORS

Our Board is currently divided into three classes serving staggered three year terms. Our amended certificate of incorporation provides for a phase out of the classification of the Board. Directors elected at this annual meetingAnnual Meeting will be elected for a two-yearone-year term expiring at our 2023 annual meeting of stockholders. Directors elected at our 2022 annual meeting of stockholders will be elected for a one-year term expiring at our 20232025 annual meeting of stockholders.

From and after our 2023 annual meeting of the stockholders, the Board will no longer be classified and each director will be elected for a one-year term. In case of any increase or decrease, from time to time, in the number of directors prior to our 2023 annual meeting of stockholders, other than those who may be elected by the holders of any series of preferred stock under specified circumstances, the number of directors added to or eliminated from each class will be apportioned so that the number of directors in each class thereafter shall be as nearly equal as possible, but in no case will a decrease in the number of directors constituting the Board shorten the term of any incumbent director.

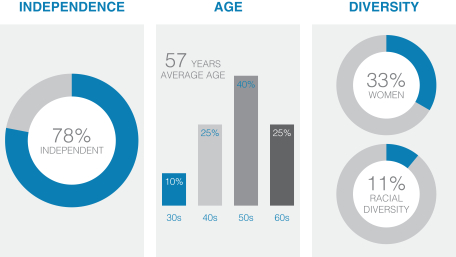

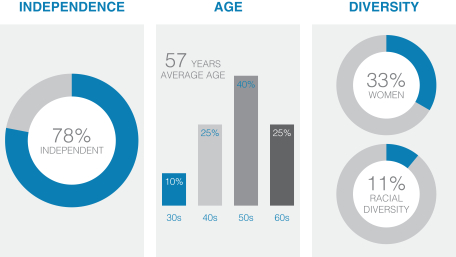

BOARD MEETINGS In 2020,2023, the Board held 15nine meetings and also acted by written consent. All of our incumbent directors attended at least 75%more than 89% of the aggregate of all meetings of the Board held duringand the periods in which they served during 2020. All of our incumbent directors also attended at least 75%committees of the aggregate of all meetings of the Board committees on which they served during 2020.2023. The rules of the NYSE require that non-management or independent directors of a listed company meet periodically in executive sessions. In addition, the rules of the NYSE require listed companies to schedule an executive session including only independent directors at least once a year. Clear Channel Outdoor’s independent directors met separately in executive session at least one time during 2023. Mr. Moreland, the independent Chair of the Board, presides over all such executive sessions. STOCKHOLDER MEETING ATTENDANCE Clear Channel Outdoor encourages, but does not require, its directors to attend the annual meetingAnnual Meeting of stockholders. All of our directors then in office attended the annual meeting of stockholders in 2020. In 2021, Board committee meetings will be held immediately following the annual meeting.2023. INDEPENDENCE OF DIRECTORS Our Board currently consists of nineten directors, one of whom currently serves as our Chief Executive Officer. For a director to be independent, the Board must determine that such director does not have any direct or indirect material relationship with Clear Channel Outdoor. Pursuant to our governance guidelines (the “Governance Guidelines”), the Board has undertaken its annual review of director independence. | | | | | | |  | | Notice and Proxy Statement 2021 5

|

The Board has adopted the following standards for determining the independence of its members: | | | | | | | | | | 1. A director must not be, or have been within the last three years, an employee of Clear Channel Outdoor. In addition, a director’s immediate family member (“immediate family member” is defined to include a person’s spouse, parents, children, siblings, mothermother- and father-in-law, sons sons- and daughters-in-law and anyone (other than domestic employees) who shares such person’s home) must not be, or have been within the last three years, an executive officer of Clear Channel Outdoor. | | | | | | | | 2. A director or immediate family member must not have received, during any 12 monthtwelve-month period within the last three years, more than $120,000 in direct compensation from Clear Channel Outdoor, other than director or committee fees and pension or other forms of deferred compensation for prior service (and no such compensation may be contingent in any way on continued service). | | | | | | | | 3. A director must not be a current partner or employee of a firm that is Clear Channel Outdoor’s internal or external auditor. In addition, a director must not have an immediate family member who is (a) a current partner of such firm or (b) a current employee of such a firm and personally works on Clear Channel Outdoor’s audit. Finally, neither the director nor an immediate family member of the director may have been, within the last three years, a partner or employee of such a firm and personally worked on Clear Channel Outdoor’s audit within that time. | | |

| | | | | | |  | | Notice and Proxy Statement 2024 1 |

| | | | | | | | | | 4. A director or an immediate family member must not be, or have been within the last three years, employed as an executive officer of another company where any of Clear Channel Outdoor’s present executive officers at the same time serve or served on that company’s compensation committee. | | | | | | | | 5. A director must not be a current employee, and no director’s immediate family member may be a current executive officer, of a material relationship party (“material relationship party” is defined as any company that has made payments to, or received payments from, Clear Channel Outdoor for property or services in an amount which,that, in any of the last three fiscal years, exceeds the greater of $1 million,$1,000,000 or 2% of such other company’s consolidated gross revenues). | | | | | | | | 6. A director must not own, together with ownership interests of his or her family, ten percent (10%) or more of a material relationship party. | | | | | | | | 7. A director or immediate family member must not be, or have been during the last three years, an executive officer of a charitable organization (or hold a similar position), to which Clear Channel Outdoor makes contributions in an amount which,that, in any of the last three fiscal years, exceeds the greater of $1 million,$1,000,000 or 2% of such organization’s consolidated gross revenues. | | | | | | | | | 8. A director must be “independent” as that term is defined from time to time by the rules and regulations promulgated by the SEC, by the listing standards of the NYSE and, with respect to at least two members of the compensation committee, by the applicable provisions of, and rules promulgated under, the Internal Revenue Code of 1986, as amended (collectively, the “Applicable Rules”). For purposes of determining independence, the Board will consider relationships with Clear Channel Outdoor and any parent or subsidiary in a consolidated group with Clear Channel Outdoor or any other company relevant to an independence determination under the Applicable Rules. | | |

The above independence standards conform to, or are more exacting than, the director independence requirements of the NYSE applicable to Clear Channel Outdoor. The above independence standards are set forth on Appendix A of the Governance Guidelines. The Board has affirmatively determined that all current directors (other than Mr. EccleshareWells and Ms. Yoon) are independent under the listing standards of the NYSE, as well as Clear Channel Outdoor’s independence standards set forth above. In addition, the Board has determined that each member currently serving on the Compensation Committee and on the Audit Committee is independent under the heightened independence standards for compensation or audit committee members under the listing standards of the NYSE and the rules and regulations of the SEC, and that each member currently serving on the Audit Committee is independent under the heightened independence standards required for audit committee members by the listing standards of the NYSE and the rules and regulations of the SEC.as applicable. In making these determinations, the Board reviewed information provided by the directors and by Clear Channel Outdoor with regard to the directors’ business and personal activities as they relate to Clear Channel Outdoor and its affiliates. In the ordinary course of business during 2020,2023, Clear Channel Outdoor entered into purchase and sale transactions for | | | | | 6 Notice and Proxy Statement 2021

| |  | | |

products and services and other ordinary course transactions with certain(i) a subsidiary of a company where Mses. Hammitt and Yoon serve as chairwoman and director, respectively; (ii) entities where Mr. Moreland serves or served as a director; (iii) an entity where Mr. Marchese serves as director, an entity where Mr. Marchese serves as partner and the chairman, and charitable organizations affiliated with membersMr. Marchese; (iv) a company that employs Mr. Dionne’s daughter in a non-executive capacity; and (v) a company that employs Mr. White’s son in a non-executive capacity. All of the Board, as described below,these transactions were for arms-length, ordinary course of business transactions, and the followingwe expect transactions of a similar nature to occur during 2024. These transactions were considered by the Board in making their independence determinations with respect to Mr.Mses. Hammitt and Yoon and Messrs. Dionne, Mr. Marchese, Mr. HobsonMoreland and Mr. Moreland: a subsidiary of a company for which Mr. Dionne served as a director paid us approximately $1,504,313 during 2020 for outdoor advertising services;

a company for which Mr. Marchese serves as a partner/co-founder paid us approximately $46,454 during 2020 for outdoor advertising services;

a client of a consulting company for which Mr. Marchese serves as chief executive officer paid us approximately $79,250 during 2020 for outdoor advertising services;

a company for which Mr. Marchese serves as a director paid us approximately $771,297 during 2020 for outdoor advertising services, and we made a refund to the same company in the amount of approximately $62,917;

a company for which Mr. Moreland serves as a director paid us approximately $79,048 during 2020 for rental fees, and we paid that company $2,200 for rental fees;

a hospital for which Mr. Moreland serves as a director paid us approximately $1.3 million during 2020 for outdoor advertising services; and

a company for which Mr. Hobson serves as a director paid us $112,905 during 2020 for outdoor advertising services.

All of the payments described above are for arms-length, ordinary course of business transactions and we generally expect transactions of a similar nature to occur during 2021.White. The Board has concluded that such transactions or relationships do not impair the independence of Mses. Hammitt and Yoon and Messrs. Dionne, Marchese, Moreland and White.

With respect to Mr. White, the directors.Board also considered that Mr. White is the Co-Founder and Managing Director of Legion Partners Asset Management, LLC and considered the relationships and transactions between Clear Channel Outdoor and Legion Partners Asset Management, LLC and its affiliates (collectively, “Legion Partners”), which are described under “Certain Relationships and Related Party Transactions.” In concluding that these relationships and transactions do not result in a “material relationship” between Clear Channel Outdoor and Legion Partners that would impede the exercise of independent judgment by Mr. White, the Board considered, among other things, that Legion Partners’ rights and obligations under the Cooperation Agreement arise directly as a result of Legion Partners’ stock The rules

| | | | | 2 Notice and Proxy Statement 2024 | |  | | |

ownership, that the amount of certain expenses of Legion Partners that Clear Channel Outdoor agreed to reimburse is below the threshold set forth in the applicable NYSE and Board-adopted standards regarding independence and that such payment does not constitute the payment of a consulting, advisory or other compensatory fee for purposes of Rule 10A-3 of the NYSE require that non-management or independent directors of a listed company meet periodically in executive sessions. In addition, the rules of the NYSE require listed companies to schedule an executive session including only independent directors at least once a year. Clear Channel Outdoor’s independent directors met separately in executive session at least one time during 2020.Exchange Act. COMMITTEES OF THE BOARD The Board has three standing committees: (i) the Audit Committee, (ii) the Compensation Committee and (iii) the Nominating and Corporate Governance Committee. Each committee consists solely of independent directors and is governed by a written charter. The committee charters are available on our website at www.investor.clearchannel.com.investor.clearchannel.com. The table below provides membership information for each committee of the Board as of December 31, 2020:March 18, 2024: Board Committee Membership | | | | | | Director Name | | Audit Committee | | Compensation Committee | | Nominating

and

Corporate

Governance

Committee | | Audit Committee | Audit Committee | | Compensation Committee | Compensation Committee | | Nominating

and

Corporate

Governance

Committee | Nominating

and

Corporate

Governance

Committee | C. William Eccleshare | | | | | | | John Dionne | |

| | | |

| | Member | Member | | | | Member | | | Member | Lisa Hammitt | | | |

| |

| | | | Member | | | Member | | Member | Member | Andrew Hobson | |  | | | | | Thomas C. King | | | |

| | | Thomas C. King | | Thomas C. King | | Thomas C. King | | Joe Marchese | | | |

| |

| W. Benjamin Moreland | | « | | | | | Joe Marchese | | Joe Marchese | | Joe Marchese | | | | | Member | | Member | W. Benjamin Moreland, Chair of the Board | | Mary Teresa Rainey | |

| | | |

| Mary Teresa Rainey | | Mary Teresa Rainey | | Mary Teresa Rainey | | | Member | | | | Chair | Scott R. Wells | | Ted White | | Ted White | | Ted White | | Ted White | | Jinhy Yoon | | | | | | | 2020 Meetings Held | | 8 | | 7 | | 4 | Jinhy Yoon | | Jinhy Yoon | | Jinhy Yoon | | Meetings Held in 2023 | | Meetings Held in 2023 | | Meetings Held in 2023 | | Meetings Held in 2023 | | | 4 | | 5 | | 4 |

« = Chair of the Board  = =The Audit Committee Chair  = Committee member = Committee member

| | | | | | |

Andrew Hobson, Chair | | Notice

John Dionne | | The Audit Committee consists of Andrew Hobson (as Chair), John Dionne, Mary Teresa Rainey and Proxy Statement 2021 7Ted White, each of whom is independent as defined under the rules of the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Hobson has been designated as an “audit committee financial expert”, as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee assists the Board in its oversight of the quality and integrity of the accounting, auditing and financial reporting practices of Clear Channel Outdoor. |

Mary Teresa Rainey | |

Ted White |

The Audit Committee

The Audit Committee consists of Andrew Hobson, Mary Teresa Rainey and John Dionne, each of whom is independent as defined under the rules of the NYSE and Rule 10A-3 of the Exchange Act. Andrew Hobson has been designated as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee assists the Board in its oversight of the quality and integrity of the accounting, auditing and financial reporting practices of Clear Channel Outdoor. The Audit Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

be responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm and any other registered public accounting firm engaged for the purpose of preparing an audit report or to perform other audit, review or attest services and all fees and other terms of their engagement; | | | | | | |  | | Notice and Proxy Statement 2024 3 |

| of preparing an audit report or to perform other audit, review or attest services and all fees and other terms of their engagement; |

review and discuss reports regarding the independent registered public accounting firm’s independence; review with the independent registered public accounting firm the annual audit scope and plan; review with management, the director of internal audit and the independent registered public accounting firm the budget and staffing of the internal audit department; review and discuss with management and the independent registered public accounting firm the annual and quarterly financial statements and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” prior to the filing of the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q;

| • | | review and discuss with management and the independent registered public accounting firm the annual and quarterly financial statements and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” prior to the filing of the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; |

review with the independent registered public accounting firm the critical accounting policies and practices used; review with management, the independent registered public accounting firm and the director of internal audit Clear Channel Outdoor’s internal accounting controls and any significant findings and recommendations; discuss guidelines and policies with respect to risk assessment and risk management; oversee Clear Channel Outdoor’s policies with respect to related party transactions; prepare the Audit Committee report for inclusion in Clear Channel Outdoor’s annual proxy statement; review information technology procedures and controls, including as they relate to data privacy and cyber-security; and review with management and the General CounselChief Legal Officer the status of legal and regulatory matters that may have a material impact on Clear Channel Outdoor’s financial statements and compliance policies. The full text of the Audit Committee’s charter can be found on our website at www.investor.clearchannel.com.investor.clearchannel.com. The Compensation Committee The Compensation Committee consists of Thomas C. King, Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE and further qualifies as a non-employee director for purposes of Rule 16b-3 under the Exchange Act. The members of the Compensation Committee are not current or former employees of Clear Channel Outdoor, are not eligible to participate in any of Clear Channel Outdoor’s executive compensation programs, do not receive compensation that would impair their ability to make independent judgments about executive compensation, and are not “affiliates” of the Company, as defined under Rule 10c-1 under the Exchange Act. The Compensation Committee administers Clear Channel Outdoor’s incentive-compensation plans and equity-based plans, determines compensation arrangements for all executive officers and makes recommendations to the Board concerning compensation for our directors. The Compensation Discussion and Analysis section of this proxy statement provides additional details regarding the basis on which the Compensation Committee determines executive compensation.

| | | | |

Thomas C. King, Chair | |

Lisa Hammitt | | The Compensation Committee consists of Thomas C. King (as Chair), Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE and further qualifies as a non-employee director for purposes of Rule 16b-3 under the Exchange Act. The members of the Compensation Committee are not current or former employees of Clear Channel Outdoor, are not eligible to participate in any of Clear Channel Outdoor’s executive compensation programs, do not receive compensation that would impair their ability to make independent judgments about executive compensation and are not “affiliates” of the Company, as defined under Rule 10C-1 under the Exchange Act. The Compensation Committee administers Clear Channel Outdoor’s incentive-compensation plans and equity-based plans, determines compensation arrangements for all executive officers and makes recommendations to the Board concerning compensation for our directors. The Compensation Discussion and Analysis section of this Proxy Statement provides additional details regarding the basis on which the Compensation Committee determines executive compensation. |

Joe Marchese |

The Compensation Committee’s primary purposes,responsibilities, which are discussed in detail within its charter, are to:include the following: assist the Board in ensuring that a proper system of long-term and short-term compensation is in place to provide performance-oriented incentives to management and that compensation plans are appropriate and competitive and properly reflect the objectives and performance of management and Clear Channel Outdoor; | | | | | 4 Notice and Proxy Statement 2024 | |  | | |

review and approve corporate goals and objectives relevant to the compensation of Clear Channel Outdoor’s executive officers, evaluate the performance of the executive officers in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determine and approve the compensation level of the executive officers based on this evaluation; | | | | | 8 Notice and Proxy Statement 2021

| |  | | |

review and adopt, and/or make recommendations to the Board with respect to, incentive-compensation plans for executive officers and equity-based plans; review and discuss with management the Compensation Discussion and Analysis to be included in Clear Channel Outdoor’s annual proxy statement and determine whether to recommend to the Board the inclusion of the Compensation Discussion and Analysis in the proxy statement;annual Proxy Statement; prepare the Compensation Committee report for inclusion in Clear Channel Outdoor’s annual proxy statement; review and make recommendations about the Company’s strategies, policies and procedures with respect to human capital management; and recommend to the Board the appropriate compensation for the non-employee members of the Board.

| • | | recommend to the Board the appropriate compensation for the non-employee members of the Board. |

The Compensation Committee has the ability, under its charter, to select and retain, in its sole discretion, at the expense of Clear Channel Outdoor, independent legal and financial counsel and other consultants necessary to assist the Compensation Committee as the Compensation Committee may deem appropriate, in its sole discretion.Committee. The Compensation Committee also has the authority to select and retain any compensation consultant to be used to survey the compensation practices in Clear Channel Outdoor’s industry and to provide advice so that Clear Channel Outdoor can maintain its competitive ability to recruit and retain highly qualified personnel. The Compensation Committee has the sole authority to approve related fees and retention terms for any of its counsel and consultants. During 2020,2023, the Compensation Committee directly engaged an independent compensation consultant, Willis Towers Watson (“Willis”WTW”), to provide executive compensation benchmarking data and incentive and retention compensation plan design advice. The Compensation Committee requested and evaluated responses from WillisWTW addressing its independence in accordance with applicable NYSE rules and concluded that Willis’WTW’s work does not raise any conflict of interest or independence concerns. The full text of the Compensation Committee’s charter can be found on our website at www.investor.clearchannel.com.investor.clearchannel.com. The Nominating and Corporate Governance Committee The Nominating and Corporate Governance Committee consists of Mary Teresa Rainey, Joe Marchese, Lisa Hammitt and John Dionne, each of whom is independent under the rules of the NYSE.

| | | | |

Mary Teresa Rainey, Chair | |

John Dionne | | The Nominating and Corporate Governance Committee consists of Mary Teresa Rainey (as Chair), John Dionne, Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE. |

Lisa Hammitt | |

Joe Marchese |

The Nominating and Corporate Governance Committee’s primary responsibilities, which are discussed in detail within its charter, include the following: identify individuals qualified to become members of the Board, consistent with criteria approved by the Board; recommend director nominees to the Board for the next annual meeting of stockholders; oversee the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; | | | | | | |  | | Notice and Proxy Statement 2024 5 |

develop and recommend corporate governance guidelines; oversee the evaluation of the Board and management; and oversee, review with management and report to the Board on the Company’s environmental, social and governance (“ESG”) strategy,ESG policies and practices in order to manage risk, lay a foundation for sustainable growth and effectively communicate ESG initiatives to stakeholders. The full text of the Nominating and Corporate Governance Committee’s charter can be found on our website at www.investor.clearchannel.com.investor.clearchannel.com. DIRECTOR NOMINATING PROCEDURES The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become Board members, developing qualification standards and other criteria for selecting Board member nominees and reviewing background information for candidates for the Board, including those recommended by stockholders. The Nominating and Corporate Governance Committee believes that all directorsBoard members must, at a minimum, meet the criteria set forth in the Corporate Governance Guidelines, which specify, among other things, that the Board of the Company seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. While we do not have a formal policy on diversity, when considering the selection of director nominees, the Nominating and Corporate Governance Committee considers individuals with diverse viewpoints, accomplishments, cultural backgrounds, professional expertise and diversity in gender, ethnicity, race, skills and geographic representation that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities to and, advocate for the long-term interests of, our shareholders. Furthermore, our Board is committed to include qualified women and individuals from underrepresented minority groups in any pool for selection of new candidates for the Board in case the size of the Board were increased or as a result of a vacancy. The Board strives to nominate directors with a variety of complementary skills sosuch that, as a group, the Board will possess the appropriate mix of experience, skills and expertise to oversee the Company’s businesses. Directors should:must: (i) have experience in positions with a high degree of responsibility; (ii) be leaders in the organizations with whichwhom they are affiliated; (iii) have the time, energy, interest and willingness to serve as a member of the Board; and (iv) be selected based upon contributions they can make to the Board and management. Our directorsMembers of our Board play a critical role in guiding our strategic direction and overseeing our management. The Nominating and Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment and using its | | | | | | |  | | Notice and Proxy Statement 2021 9

|

diversity of experience. The Nominating and Corporate Governance Committee evaluates each incumbent director to determine whether heshe or shehe should be nominated to stand for re-election,reelection based on the types of criteria outlined above as well as the director’s contributions to the Board during their current term. The Nominating and Corporate Governance Committee will consider as potential nominees individuals properly recommended by stockholders. Recommendations concerning individuals proposed for consideration should be addressed to the Board, c/o Corporate Secretary, Clear Channel Outdoor Holdings, Inc., 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. Each recommendation should include a personal biography of the suggested nominee, an indication of the background or experience that qualifies the person for consideration and a statement that the person has agreed to serve if nominated and elected. The Board evaluates candidates recommended by stockholders in the same manner in which it evaluates other nominees. Stockholders who themselves wish to effectively nominate a person for election to the Board, as contrasted with recommending a potential nominee to the Board for its consideration, are required to comply with the advance notice and other requirements set forth in our bylaws.By-laws and Rule 14a-19 of the Exchange Act (the universal proxy rules). BOARD LEADERSHIP STRUCTURE The Board exercises its discretion in combining or separating the position of chairChair of the Board and CEOChief Executive Officer as it deems appropriate in light of prevailing circumstances. Mr. EccleshareWells currently serves as our CEOChief Executive Officer, and Mr. Moreland currently serves as ourthe independent Chair of theour Board. The CEOChief Executive Officer is responsible for the strategic direction, day-to-day leadership and performance of the Company, while the Chair of the Board provides overall leadership to our Board. TheThis leadership structure allows the CEOChief Executive Officer to focus on his operational responsibilities, while keeping a measure of independence between the oversight function of our Board and those operating decisions. Our Board believes that this leadership structure provideshas historically provided an appropriate | | | | | 6 Notice and Proxy Statement 2024 | |  | | |

allocation of roles and responsibilities and ishas been in the best interests of stockholders and believes that it continues to be appropriate and in the best interests of stockholders at this time.

| | | | W. Benjamin Moreland

| | Mr. Moreland has been our independent Chair since May 2019. The Board views the independent Chair as a liaison between the Board and the Company’s Chief Executive Officer and other members of management and believes the powers and authority of the Chair strengthen the Board’s role in risk oversight. Mr. Moreland exercises effective leadership and sets the tone at the top. He leverages, from multiple leadership positions and positions on boards of large public companies, his breadth of experience in oversight areas, including in financial and transactional matters, as well as his strategic insight to strengthen independent oversight of management. Our independent Chair has power and authority to do the following: • preside at all meetings of non-management directors when they meet in executive session without management participation; • set agendas, priorities and procedures for meetings of non-management directors meeting in executive session without management participation; • add agenda items to the established agenda for meetings of the Board and its committees; • request access to the Company’s management, employees and its independent advisers for purposes of discharging his duties and responsibilities as a director; and • retain independent outside financial, legal or other advisors at any time, at the expense of the Company, on behalf of the Board or any committee or subcommittee of the Board. |

In addition, at any time when the Chair might not be an independent director, the Board has created the office of the Presiding Director to serve as the lead non-management director of the Board. If required, the Presiding Director would be an “independent” director, as that term is defined from time to time by the listing standards of the NYSE and as determined by the Board in accordance with the Governance Guidelines. If the Chair of the Board is an independent director, then the Chair of the Board assumes the responsibilities of the Presiding Director that are set forth above. Throughout the year, we engage with our stockholders to discuss and receive feedback on various matters, including our governance structure. SELF-EVALUATION Our Board conducts an annual self-evaluation process to determine whether the Board, its committees and the directors are functioning effectively. This includes survey materials as well as individual, private conversations between directors and the Chair of the Board, as needed, and a report to, and discussion of survey results with, the Nominating and Corporate Governance Committee and the full Board. The survey materials solicit feedback on organizational issues,matters, business strategy, and financial matters, board structure and meeting administration. The directors use the survey materials, discussions with the Chair of the Board, as needed, and discussions with the full Board to provide feedback, identify themes for the Board to consider, suggest specific action steps and review Board agendas. In addition, focus areas identified through the evaluation are incorporated into the Board’s agendaand, as applicable, its committees’ agendas for the following year to monitor progress. The annual Board performance evaluation is also a primary determinant for Board tenure. Annually, the Nominating and Corporate Governance Committee reviews progress against focus areas identified in the self-evaluation. Each committee also conducts its own annual self-evaluation to assess the functioning of the committee and the effectiveness of the committee members, including the committee chair.

| | | | | | |  | | 10 Notice and Proxy Statement 20212024 7

| |  | | |

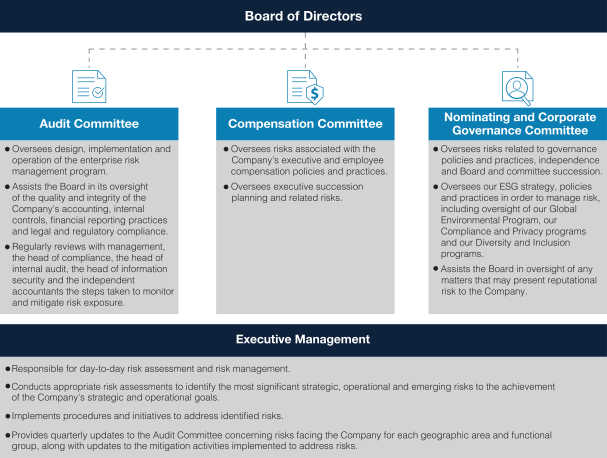

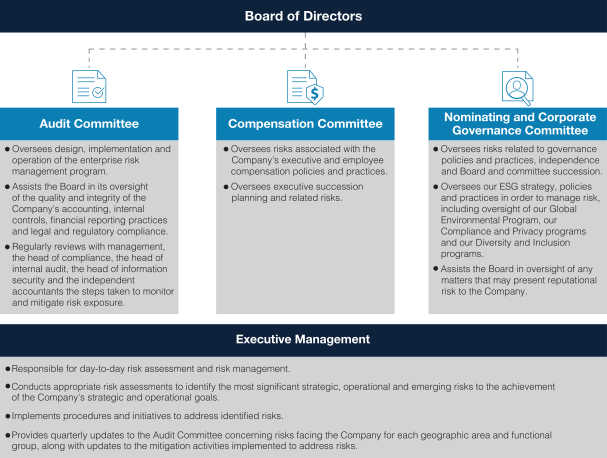

RISK MANAGEMENT Our Board has overall responsibility for the oversight of our enterprise risk management process, which is guided by the COSO Enterprise Risk Management Framework three lines of defense model, including operational managementOperational Management as the First Line of Defense, Compliance and Information Security as the Second Line of Defense and Internal and External Audit as the Third Line of Defense. The Board sets the tone at the top as it relates to enterprise risk management and encourages management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day operations. Our risk management philosophy strives to: timely identify the material risks that we face; communicate necessary information with respect to material risks to senior management and, as appropriate, to the Board or relevant Board committee; implement appropriate and responsive risk management strategies consistent with our risk profile; and integrate risk management into our decision-making. Our management conducts a formal risk assessment of the Company’s business, including probability and potential economic and reputational impact assessments, and develops mitigation actions and monitoring plans. The Board has designated the Audit Committee to broadly oversee enterprise risk management in accordance with our Audit Committee Charter.its charter. Under the oversight of the Audit Committee, and with the support of the Company’s compliance function and the Company’s internal and external audit functions, we operate an enterprise-wide risk management governance framework that sets standards and provides guidance for the identification, assessment, monitoring and control of the most significant risks facing the Company and that have the potential to affect stockholder value, our customers and colleagues, the communities in which we operate and the safety and soundness of the Company. The Audit Committee then reports to the Board quarterly regarding briefings provided by management and advisors, as well as the Audit Committee’s own analysis and conclusions regarding the adequacy of our risk management processes. | | | | | 8 Notice and Proxy Statement 2024 | |  | | |

The Board also exercises its oversight of our enterprise risk management process with support from the Compensation Committee and the Nominating and Corporate Governance Committee, each of which has oversight responsibilities for risks that may fall within their areaareas of responsibility and expertise. For example, the Compensation Committee reviews human capital related risks, and the Nominating and Corporate Governance Committee regularly reviews ESG risks. The Board receives independent reports from each committee at its quarterly meetings. | | | | | | |  | | Notice and Proxy Statement 2021 11

|

The Board’s oversight of risk management requires close interaction between the full Board, each of theits committees and executive management. The Company’s risk oversight framework and key areas of responsibility are illustrated below:

| | | | | | |  | | Notice and Proxy Statement 2024 9 |

SUCCESSION PLANNING At least annually, the Compensation Committee reviews the Company’s talent management and succession plan, including with respect to the Chief Executive Officer and other executive positions. This includes the review and evaluation of development plans for potential successors to the Chief Executive Officer role and other keyexecutive positions. As part of the Board’s ongoing succession planning processes, in December 2023, the Board, with the recommendation of the Compensation Committee, appointed David Sailer (formerly Executive Vice President, Chief Financial Officer of the Americas) to succeed Brian Coleman in the role of Executive Vice President, Chief Financial Officer of the Company, effective as of March 1, 2024. Developing talent at all levels of the Company is a priority for the Company.us. We are focused on providing the Board with additional opportunities to interact with senior management, including providing informal feedback sessions where directors meet with groups of senior management below the executive level, which gives management unique access to the Board and also facilitates a deeper understanding of the organization byamong the Board. The Company also offers various talent development programs throughout the organization focused on building leadership and management skills, career development and other areas. CORPORATE GOVERNANCE Our corporate governance practices are established and monitored by the Board. The Board, with assistance from itsthe Nominating and Corporate Governance Committee, periodically assesses our governance practices in light of legal requirements and governance best practices. Our primary governing documents include: | | ○ | | Audit Committee Charter |

| | ○ | | Compensation Committee Charter |

| | ○ | | Nominating and Corporate Governance Committee Charter |

Code of Business Conduct and Ethics | | | | | 12 Notice and Proxy Statement 2021

| |  | | |

These documents are available on our website at www.investor.clearchannel.com.investor.clearchannel.com. We encourage our stockholders to read these documents, as we believe they illustrate our commitment to good governance practices. Certain key provisions of these documents are summarized below.

| | | | | 10 Notice and Proxy Statement 2024 | |  | | |

GOVERNANCE GUIDELINES We operate under Governance Guidelines that set forth our corporate governance principles and practices on a variety of topics, including director qualifications, the responsibilities of the Board, independence requirements and the composition and functioning of the Board. Our Governance Guidelines are designed to maximize long-term stockholder value, align the interests of the Board and management with those of our stockholders and promote high ethical conduct among our directors. The Governance Guidelines include, but are not limited to, the following key practices to assist the Board in carrying out its responsibility forresponsibilities in connection with the business and affairs of Clear Channel Outdoor: | | | | | 1. | | Director Responsibilities | | | The basic responsibility of a director is to exercise his or her business judgment and act in what heshe or shehe reasonably believes to be in the best interests of Clear Channel Outdoor and its stockholders. Directors are expected to attend Board meetings and meetings of committees on which they serve and to spend the time needed, and meet as frequently as necessary, to properly discharge their responsibilities. | | | |  | 2. | | Self-Evaluation Process | | | The Board and each standing committee of the Board will conduct an annual self-evaluation to determine whether it and its committees are functioning effectively. The Nominating and Corporate Governance Committee is responsible for overseeing the self-evaluation process and for proposing any modification or alterations in Board or committee practices or procedures. | | | |  | 3. | | Executive Sessions of Non-Management Directors | | | The non-management directors and/or the independent directors meet periodically in executive session without management participation. | | | |  | 4. | | Board Access to Senior Management | | | Directors have complete access to Clear Channel Outdoor’s management, employees and its independent advisors for purposes of discharging their duties and responsibilities as directors and can initiate contact or meetings through the CEOChief Executive Officer or any other executive officer. | | | |  | 5. | | Board Access to Independent Advisors | | | The Board and each Board committee have the power to retain independent legal, financial or other advisors as they may deem necessary, at our expense. | | | |  | 6. | | Board Tenure | | | The Board believes that term limits on director service and a predetermined retirement age impose arbitrary restrictions on Board membership. Instead, the Board believes directors who, over a period of time, develop an insight into Clear Channel Outdoor and its operations provide an increasing contribution to Clear Channel Outdoor as a whole. The annual board performance evaluation is a primary determinant for Board tenure. | | | |  | 7. | | Directors Who Change Their Current Job Responsibilities | | | A director who changes the nature of the job heshe or shehe held when heshe or shehe was elected to the Board shall promptly notify the Board of theany such change. This does not mean that such director should necessarily leave the Board. There should, however, be an opportunity for the Board to review the continued appropriateness of Board membership under these new circumstances. | | | |  | 8. | | Service on Multiple Boards | | | To enable the Board to assess a director’s effectiveness and any potential conflicts of interest, any director who serves on more than three other public company boards must advise the Chair in advance of accepting an invitation to serve as a member of another public company board. | | | |  | 9. | | Management Development and Succession Planning | | | The Board or a committee of the Board will periodically consider management development and succession planning, including short-term succession planning for certain of Clear Channel Outdoor’s most senior management positions. |

| | | | | | |   | | Notice and Proxy Statement 2021 132024 11 |

BOARD COMMITTEE CHARTERS Each standing committee of the Board operates under a written charter that has been adopted by the Board. We have three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. TheEach committee charters setcharter sets forth the purpose, responsibilities of the respective committee and discussdiscusses matters such as committee membership requirements, number of meetings and the setting of meeting agendas. The charters are assessed at least every other year, or more frequently as the applicable committee may determine, and are updated as needed. More information on the Board’s standing committees, their respective roles and responsibilities and their charters can be found under “The Board of Directors and Corporate Governance—Committees of the Board.”Board” above. CODE OF BUSINESS CONDUCT AND ETHICS Our Code of Business Conduct and Ethics (the “Code of Conduct”“Code”) applies to all of our officers, directors, and employees including(including our principal executive officer, principal financial officer and principal accounting officer.officer), interns, contractors and agents throughout our corporate structure. Our Code of Conduct constitutes a “code of ethics”, as defined by Item 406(b) of Regulation S-K. Our Code of Conduct is publicly available on our website at www.investor.clearchannel.com.investor.clearchannel.com. We intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of the Code of Conduct that applies to our principal executive officer, principal financial officer or principal accounting officer and relates to any element of the definition of code of ethics set forth in Item 406(b) of Regulation S-K by posting such information on our website www.investor.clearchannel.com.at investor.clearchannel.com. STOCKHOLDER AND INTERESTED PARTY COMMUNICATION WITH THE BOARD Stockholders and other interested parties may contact an individual director, the Chair of the Board, the Board as a group or a specified Board committee or group, including the non-management directors as a group, by sending regular mail to the following address: Board of Directors c/o Corporate Secretary Clear Channel Outdoor Holdings, Inc. 4830 North Loop 1604W, Suite 111 San Antonio, Texas 78249 | | | | | 1412 Notice and Proxy Statement 20212024

| |   | | |

Security Ownership of Certain Beneficial Owners and ManagementSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Except as otherwise stated, the table below sets forth information concerning the beneficial ownership of Clear Channel Outdoor’s common stock as of March 9, 202118, 2024 for: (1) each director currently serving on our Board, and eachall of thewhom are nominees for director; (2) each of our named executive officers; (3) our directors and executive officers as a group; and (4) each person known to Clear Channel Outdoor to beneficially own more than 5% of any class of Clear Channel Outdoor’s outstanding shares of common stock. At the close of business on March 9, 2021,18, 2024, there were 467,859,064483,720,129 shares of Clear Channel Outdoor’s common stock outstanding. Except as otherwise noted, each stockholder has sole voting and investment power with respect to the shares beneficially owned. Each share of Clear Channel Outdoor common stock is entitled to one vote on matters submitted to a vote of the stockholders. Each share of our common stock is entitled to share equally on a per shareper-share basis in any dividends and distributions by us. | Name and Address of Beneficial Owner(a) | | Number of

Shares of

Common Stock | | | Percent of

Common

Stock(b) | | | Number of

Shares of

Common Stock | | | Percent of

Common

Stock(b) | | Holders of More than 5%: | | | | | PIMCO(c) | | | 104,258,819 | | | | 22.4 | % | | | 104,796,992 | | | | 21.7 | % | Ares Management(d) | | | 36,999,772 | | | | 7.9 | % | | | 55,829,046 | | | | 11.5 | % | The Vanguard Group(e) | | | 30,977,587 | | | | 6.6 | % | | | 36,323,087 | | | | 7.5 | % | Mason Capital Management LLC(f) | | | 30,364,927 | | | | 6.5 | % | Arturo R. Moreno(f) | | | | 32,924,370 | | | | 6.8 | % | BlackRock, Inc.(g) | | | | 27,671,438 | | | | 5.7 | % | Legion Partners(h) | | | | 25,948,728 | | | | 5.4 | % | | Named Executive Officers, Executive Officers and Directors: | Named Executive Officers, Executive Officers and Directors: | | | | C. William Eccleshare(g) | | | 2,418,253 | | | | * | | Named Executive Officers, Executive Officers and Directors: | | Named Executive Officers, Executive Officers and Directors: | | Named Executive Officers, Executive Officers and Directors: | | Named Executive Officers, Executive Officers and Directors: | | Scott R. Wells(i) | | | | 2,722,250 | | | | | * | Brian D. Coleman(h)(j) | | | 425,342 | | | | * | | | | 1,326,178 | | | | | * | Scott R. Wells(i) | | | 1,295,564 | | | | * | | Lynn A. Feldman(j) | | | 357,344 | | | | * | | Lynn A. Feldman(k) | | | | 873,825 | | | | | * | Justin Cochrane(l) | | | | 608,967 | | | | | * | Jason A. Dilger(k)(m) | | | 136,532 | | | | * | | | | 333,390 | | | | | * | John Dionne(l)(n) | | | 163,163 | | | | * | | | | 382,300 | | | | | * | Lisa Hammitt(m)(o) | | | 115,369 | | | | * | | | | 253,265 | | | | | * | Andrew Hobson(n)(p) | | | 315,369 | | | | * | | | | 521,472 | | | | | * | Thomas King(o)(q) | | | 173,992 | | | | * | | | | 511,271 | | | | | * | Joe Marchese(p)(r) | | | 186,963 | | | | * | | | | 520,791 | | | | | * | W. Benjamin Moreland(q)(s) | | | 1,012,117 | | | | * | | | | 1,390,821 | | | | | * | Mary Teresa Rainey(r)(t) | | | 115,369 | | | | * | | | | 321,472 | | | | | * | Ted White (u) | | | | 25,948,728 | | | | 5.4 | % | Jinhy Yoon | | | — | | | | — | | | | — | | | | | — | All directors and executive officers as a group (13 individuals)(s) | | | 6,715,377 | | | | * | | All directors and executive officers as a group (14 individuals)(v) | | | | 34,869,497 | | | | 7.2 | % |